‘Twas Benjamin Franklin who said, “In this world, nothing can be said to be certain, except death and taxes.”

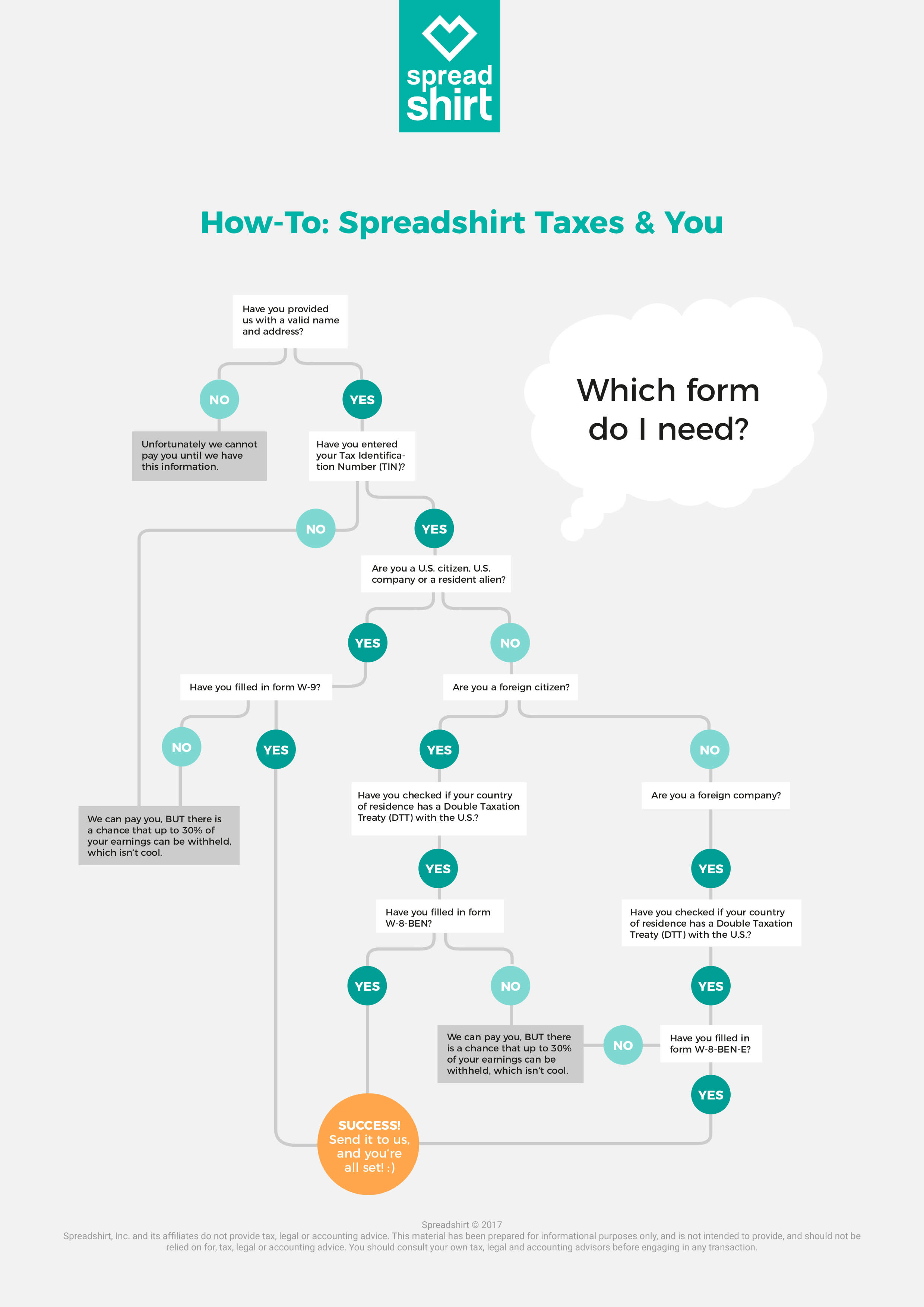

With the end of 2017 approaching, it’s time we do the taxation information dance. The following article is a “Spreadshirt Taxation for Dummies” guide to help you determine what you need to do to meet your Spreadshirt taxation obligations. Please read the information below carefully. A few things are required of all Spreadshirt Partners, and some are specific to certain types of Partners. Find out which group you fit into with our handy flowchart, and follow the information below to ensure your compliance.

1. All Spreadshirt Partners

The following information required of ALL Spreadshirt Partners:

- Name: First and last name

- Address: House number and street, city, country, ZIP code

If you are currently receiving payments from Spreadshirt, we already have your information on file, but we suggest that you check it again for accuracy. Incorrect information will result in non-payment of Spreadshirt earnings until correct information is provided.

2. Partners Who Are U.S. Citizens Residing Within or Outside of the United States or Resident Aliens

The following information is required of Partners who are U.S. citizens or companies, residing within or outside of the United States or are resident aliens. This Partner type is defined by the IRS as a U.S. citizen or resident alien, any domestic estate or trust, or a Partnership, company or corporation created in the U.S. and organized under its laws:

- Name: First and last name

- Address: House number and street, city, country, ZIP code

- A valid TIN, SSN or EIN

- A filled-in W-9 form (also available for download in the User/Partner area)

Please note: for the W-9 form to be valid, you must put your User ID in section 7 where it says, “List account number(s) here (optional)”. The data on the form must be consistent with what is provided in your Spreadshirt account.

Please download, fill out, sign, and email your W-9 form as an attachment to taxation@spreadshirt.com.

3. Partners Who Are Non-U.S. Citizens

The following information is required of Partners who are non-U.S. citizens. This Partner type is defined by the IRS as a foreign individual, non-resident alien, or someone earning income from U.S. sources (in this case, Spreadshirt, Inc.):

- Name: First and last name

- Address: House number and street, city, country, ZIP code

- A valid Foreign TIN

- A filled-in W-8-BEN form (also available for download in the User/Partner area)

Please note: for the W-8-BEN form to be valid, you must put your User ID in section 7 where it says, “Reference number(s) (see instructions)”. The data on the form must be consistent with what is provided in your Spreadshirt account.

Please download, fill out, sign, and email your W-8-BEN form as an attachment to taxation@spreadshirt.com.

For European Partners, you can find your Foreign TIN by following this link.

For Partners from other countries, please contact your local tax consultant or local tax authorities to obtain the required information.

4. Partners Who Are Non-U.S. Companies

The following information is required of Partners who are non-U.S. companies. This Partner type is defined by the IRS as a foreign company earning income from U.S. sources (in this case, Spreadshirt, Inc.):

- Name: First and last name

- Address: House number and street, city, country, ZIP code

- A valid Foreign TIN

- A filled-in W-8-BEN-E-form (also available for download in the User/Partner area)

Please note: for the W-8-BEN-E form to be valid, you must put your User ID in section where it says, “Reference number(s) (see instructions)”. The data on the form must be consistent with what is provided in your Spreadshirt account.

Please download, fill out, sign, and email your W-8-BEN-E form as an attachment to taxation@spreadshirt.com.

For European Partners, you can find your Foreign TIN by following this link.

For Partners from other countries, please contact your local tax consultant or local tax authorities to obtain the required information.

IMPORTANT INFORMATION FOR U.S. PARTNERS (INDIVIDUALS, COMPANIES AND RESIDENT ALIENS)

- Commissions earned at Spreadshirt must be declared as income. This is usually done with a 1099-MISC form. Please consult your tax advisor or the IRS website for more information on how to declare your commission earnings.

- If you have received $600 or more in commissions the previous year, Spreadshirt will send out a 1099-MISC form by January 31st the following year.

- If you have received $600 or more in Affiliate/Volume Commissions the previous year, or $10 or more in design commissions, you will also receive the 1099-MISC form.

- If you have received a commission the previous year, but have not submitted a W-9 form, Spreadshirt will also send out a 1099-MISC form by January 31st the following year.

IMPORTANT INFORMATION FOR FOREIGN PARTNERS (INDIVIDUALS AND COMPANIES)

- All non-U.S. Partners are subject to U.S. tax at a rate of 30% on income they receive from U.S. sources (in this case, Spreadshirt, Inc.)

- If a Partner resides in a country that has a Double Taxation Treaty (DTT) agreement with the U.S., the Partner can avail themselves of a reduced rate of tax deducted.

- IRS provides an A-Z list of all U.S. tax treaties. If you are unsure if your country of residence has a double taxation treaty agreement with the U.S., you can check by clicking here.

- By signing Form W-8-BEN(-E), Partner makes a declaration about their tax residency and requests the benefits of the tax treaty that exists between the U.S. and their country of residence.

- Commissions earned at Spreadshirt must be declared as income with form 1042-S, which Spreadshirt will send you. Please consult your tax advisor or the IRS website for more information on how to declare your commission earnings.

- For International Shop owners there is no commission threshold to receive a 1042-S form: if you have received any commission earnings the previous year, Spreadshirt will send out the 1042-S form by April 15th the following year, at the latest.

For complete information regarding Spreadshirt, taxation, and you, please refer to:

- Spreadshirt Help-section: Earning Money With Spreadshirt

- Spreadshirt’s General Terms & Conditions

- Spreadshirt’s Shop Owner Terms & Conditions

- Consult your tax advisor/consultant

There is nothing quite as taxing (pun intended) as taxation information and the requirements associated with it. Please take your time, and be sure you have provided the correct information and forms to properly file your taxes associated with Spreadshirt.

Spreadshirt, Inc. and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Hi, I’m from Myanmar. We can’t get TIN here. They only pay TIN to Companies. Is there anything I can do?

We are a 501c3 wanting to set up a shop as a fundraiser. How do taxes work in that case?

At which date can i send the W-8BEN form to you and what is the last date I have a chance to send it?

Hello,

I’m from germany.

I already signed the Form W-8-BEN.

Now Spreadshirt sent me the form 1042-S for the year 2019.

What shall I do with Copy B, Copy C and Copy D?

And why is there no original?

Are these only for information for the german tax office, or do I have to fill them out and send back to spreadshirt?

I really don’t know what to do.

TIA

Michael

Hi I’m from Morocco and I don’t know about W-8-BEN and Foreign TIN and how can I get this formers.

İ live in Turkey but I dont know nothing about Claim of Tax Treaty Benefits .İs it important for tax?

Hi, I am living in UGANDA, Africa.

I wanted to sell my T-shirts design on the marketplace and I am wondering if taxes apply for both shop and marketplace or its shop only?

I am in Canada and so confused and need some serious help here and quick as I have some major business coming soon

what forms do I need to fill out I own my business Journey with me designs here in Calgary Alberta and I am sole proprietor to this business.

Hello I’m from Saudi Arabia and we don’t have a TIN in this case to begin selling on Spreadshirt Website. Kindly advice.

Many Thanks

“All non-U.S. Partners are subject to U.S. tax at a rate of 30% on income they receive from U.S. sources (in this case, Spreadshirt, Inc.)”

I’m from and live in Uruguay, does this means that I’m going to loose 30% from each sale I make in my Spreadshirt store because I still have to pay U.S. taxes, even when I already do pay taxes in my own country???

I sent you guys my tax sheet I wanted to know if you guys got it